Listed A-REITs staged a strong comeback in 2021, with the S&P/ASX 200 A-REIT Accumulation Index delivering a total return of 26.1% for the year. A-REITs also outperformed the broader S&P/ASX 200 Accumulation Index, which was up 17.2%.

The strong 2021 result contrasts with the prior year, 2020, when earnings were more impacted by the first waves of COVID-19 as well as mandated rent relief for tenants. Of note is that capital gains in most AREITs have outstripped income returns off the back of significant increase in property valuations.

While previous cycles have demonstrated similar behaviour, the current cycle seems to be driven by: (1) a substantial increase in supply/ demand of new capital seeking to invest in real assets; (2) Australian real estate rerating to line up with its global peers; and (3) a historically low interest rate environment.

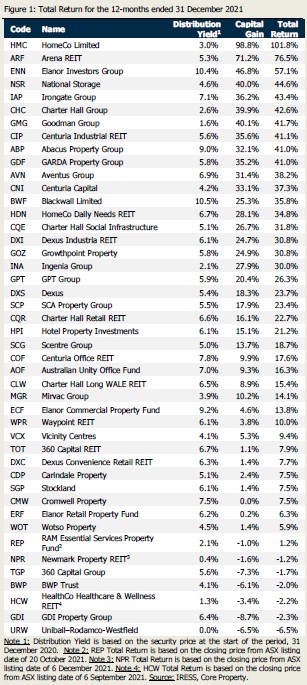

Core Property has ranked 45 property securities based on their total return for the 12 months to 31 December 2021. The table shows the Total Return which consists of a distribution return as well as a capital gain/loss as a result of the security price movement.

39 out of the 45 stocks delivered a positive return for the year, highlighting a renewed confidence in the A-REIT sector compared to 2020.

Home Consortium (ASX: HMC) was the strongest performer with a very impressive 101.8% return. The result was supported by strong growth initiatives for Funds Under Management (FUM), including the proposed merger of its HomeCo Daily Needs REIT (ASX: HDN) with Aventus Group (ASX: AVN). The merger is targeted to be completed by mid-February 2022 and is expected to increase HMC’s FUM to $5.0 billion (from $1.7 billion), with HMC targeting this to reach $10 billion by 2024. High returns were also delivered by HDN (+34.8%) and AVN (+38.2%).

Continued FUM growth also underpinned strong returns from fund managers such as Elanor Investors Group (ASX: ENN, +57.1%), Charter Hall Group (ASX: CHC, +42.6%), Goodman Group (ASX: GMG, +41.7%) and Centuria Capital (ASX: CNI, +37.3%).

The strong returns have been provided against a backdrop that assumes the economy continues to work around the impacts of COVID-19. Many of 2020’s weaker performing stocks have become some of the strongest performers in 2021.

Core Property expects the key themes to impact stocks in 2022 will include a focus on the strength of earnings from property portfolios. We also anticipate a renewed focus on interest rates during the 2022, with concerns that higher rates, or the expectation of higher rates, will make operating conditions more challenging, and consequently impact property valuations. During such periods it is usually the better managers with low gearing who can perform.

The impact of COVID-19 on the listed market can be characterised as being volatile in 2020, following by a strong recovery in 2021. Our expectations are that over the next 12 months there will be a renewed focus on growth. Managers with portfolios that can demonstrate sustainable growth are likely to be rewarded well. |

Click to read the full report