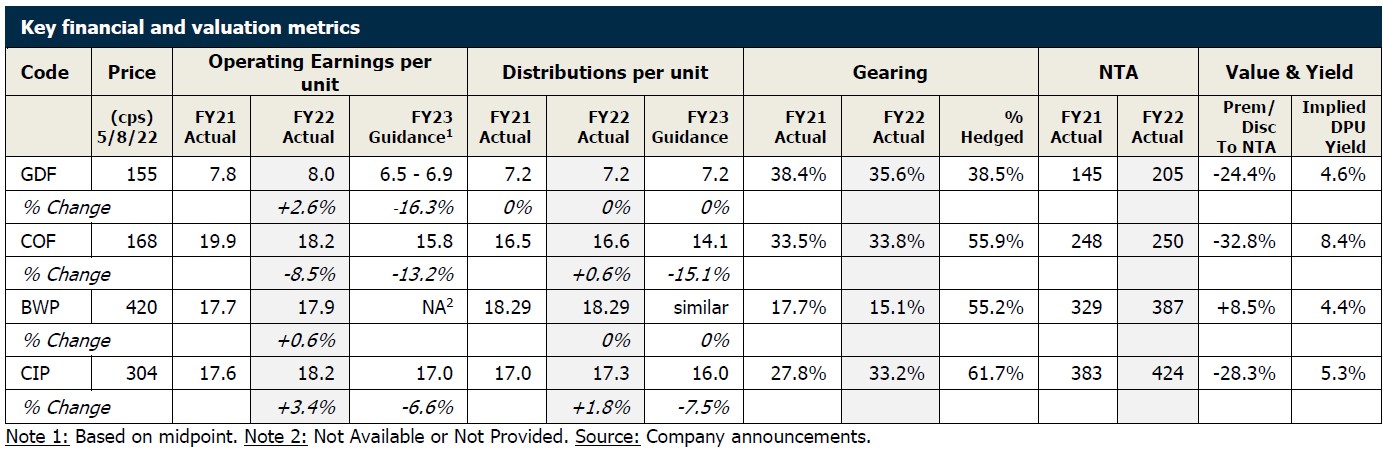

Core Property has reviewed the results from property securities which reported in Week 1 of the August 2022 reporting season. During the week of Monday 1 August – Friday 5 August 2022, we reviewed the results from GARDA Property Group (ASX: GDF), Centuria Office REIT (ASX: COF), BWP Trust (ASX: BWP) and Centuria Industrial REIT (ASX: CIP).

Given the sharp increase in interest rates over the past few months, we have been monitoring the impact this will have on earnings and distributions. Interest rates have increased by a total of 1.75% so far this year, beginning on 4 May (+0.25%), 8 June (+0.50%), 6 July (+0.50%) and 2 August (+0.50%). The RBA cash target rate now stands at 1.85%. Due to the timing of the rises, there was no little impact on the June 2022 results, and the four listed property securities all reported results that were in line with their guidance.

However, higher interest rates are expected to impact FY23 earnings. The overall impact will depend on how much debt is used, how much hedging is in place, as well as other earnings adjustments.

-

GARDA Property Group (ASX: GDF) expects the largest impact on earnings of -16.3% (midpoint). This is a factor of GDF’s gearing at 35.6%, with 38.5% of the debt being hedged.

-

BWP Trust (ASX: BWP) has one of the lowest levels of gearing at 15.1%. Of this, 55.2% is hedged, which effectively means that the gearing that is exposed to interest rate rises is only 6.8%. Whilst BWP does not give specific earnings guidance, it is targeting to maintain distributions at the same level in FY23, with a portion being paid out of capital profits. BWP is one of the few property securities that is currently trading at a premium to its NTA at the moment.

-

Centuria Office REIT (ASX: COF) expects FY23 earnings to be impacted by -13.2%, and Centuria Industrial REIT (ASX: CIP) expects an impact of -6.6%. Whilst they both have similar levels of gearing (33.8% and 33.2%), the impact on CIP is lesser due to a greater use of hedging (61.7% of debt is hedged). CIP also benefits from strong rental increases in the industrial sector which lessens the impact that interest rates will have on its earnings.

-

We expect interest rates to impact other property securities’ guidances as they report over the coming weeks, with the likelihood that further FY23 guidance will be impacted by double digit declines.

COF is trading on a higher distribution yield of 8.4% compared to the other three securities BWP (4.4%), GDF (4.6%) and CIP (5.3%). This is seen to be reflective of the uncertainty in the office sector as tenants continue to manage their way through a changing work environment impacted by work from home models as well as an increasing ESG focus.

Portfolio valuations have remained strong for the June results, with the 4 property securities all reporting increases in NTA per unit for the year. Capitalisation rates have continued to reduce in the six months to June 2022, albeit at a slower pace than previous periods.