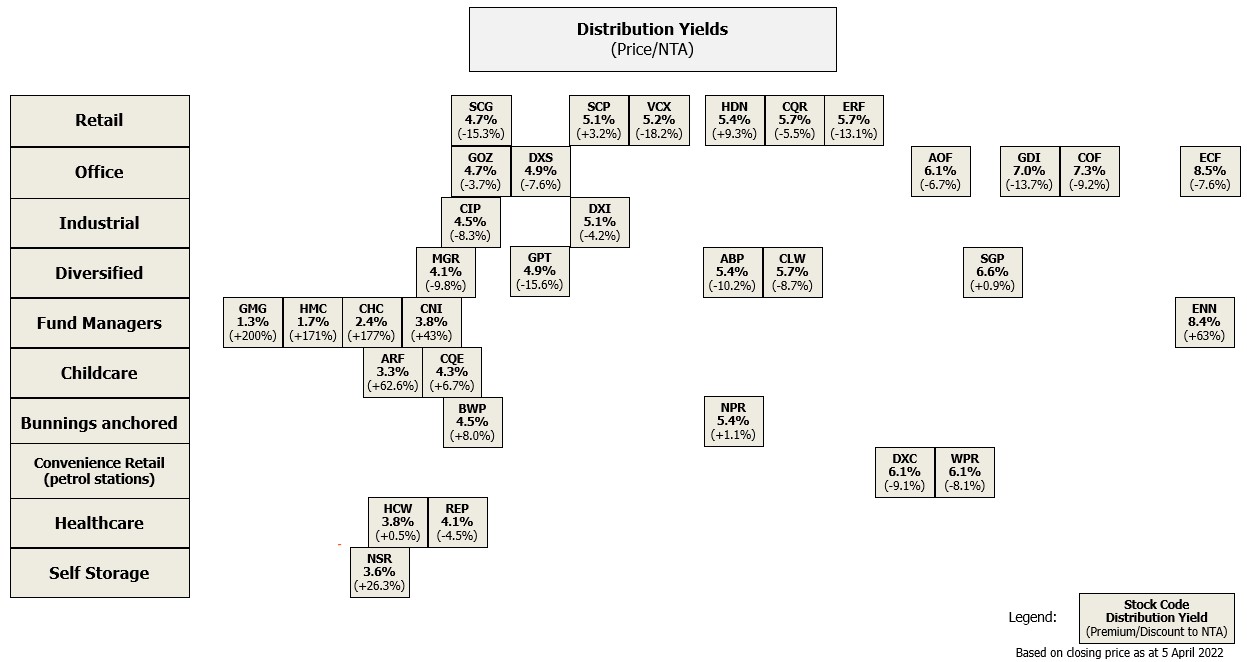

We have reviewed some key trading metrics to see how the listed property securities are performing on a sector-by-sector basis. Some of the key findings are summarised below:

- The majority of the portfolios are trading on distribution yields of around 4% - 6%. We consider this to represent the current “core” range for distributions in the listed sector.

- Apart from the Fund Managers, the majority of the listed portfolios are trading at a discount to their NTA per unit. The exception appears to be portfolios which are seen to be resilient in the current economic climate, such as convenience-based retail portfolios (SCP, HDN), childcare portfolios (ARF, CQE), Bunnings anchored retail portfolios (BWP, NPR) and Self-Storage (NSR).

- Fund Managers with a track record of strong growth are valued highly by the market and currently trade of much lower yields.

- The Industrial sector remains in high demand as investors seek to back well-located properties which are integral to the supply chain of goods in the economy. The yields on CIP and DXI are tight, in the range of 4.5% - 5.1%

- The Office sector continues to face uncertainty in demand because of COVID and how much space is required by tenants. The securities in the Office sector have a wide range of distribution yield, of 4.7% - 8.5%.

- The Retail Sector is currently delivering yields of around 4.7% - 5.7%.

- Specialised portfolios remain attractive as investors flock to portfolios which offer a degree of resilience in sectors such as Childcare (3.3% - 4.3%), Bunnings anchored retail (4.5% - 5.4%), healthcare (3.8% – 4.1%) and Self-Storage (3.6%). Convenience retail/petrol stations are currently offering yields of 6.1%.