The listed A-REITs delivered a weak performance in the 6 months to 30 June 2022. The S&P/ASX 200 A-REIT Accumulation Index delivered a -23.5% total return for the 6-month period, whilst the broader S&P/ASX 200 Accumulation Index delivered a -9.9% total return.

The weak performance was driven by interest rate concerns in the market. The RBA increased the cash rate by 1.25% across 3 consecutive months, bringing the cash rate to 1.35%. The rate rise was the first time the RBA has increased interest rates since November 2010.

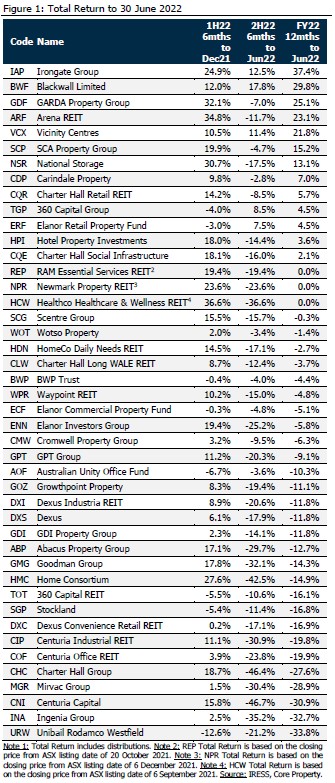

The increase in interest rates impacted the property sector, with the vast majority of stocks delivering a weaker performance in the 6 months to June 2022, compared to the 6 months to December 2021. Whilst the listed property stocks are generally geared at modest levels of 20% - 35%, the market remains concerned about the impact that interest rates will have on earnings as well as valuations. Core Property reviewed 44 property stocks for their total return over these periods.

Only 5 stocks delivered a positive return in the 6 months to June 2022 (IAP +12.5%, BWF +17.8%, VCX +11.4%, TGP +8.5% and ERF +7.5%). The majority of property stocks delivered negative returns which were in the -15% to -40% range.

Irongate Group (ASX: IAP) was the strongest performer for the year, with a 37.4% return delivered off the back of a takeover offer from Charter Hall (ASX: CHC). IAP was subsequently delisted on 6 July 2022, following the completion of the takeover.

Fund Managers were the hardest hit in the 6 months over concerns about how they would deliver growth in the high interest rate environment. In the 6-month period weaker returns were delivered by CHC (-46.4%), HMC (-42.5%), GMG (-32.1%), ENN (-25.2%) and CNI (-23.8%).

The various managers have announced only small movements in capitalisation rates for the June 2022 reporting period. As such, we do not expect the June 2022 results will deliver any material movements in the valuation of portfolios. However, beyond the June 2022 reporting period, the market has factored in the potential for valuation downside, given the recent price weakness.

Higher interest rates are also expected to impact earnings and distributions for the FY23 period, and the market will be looking to the August 2022 reporting period for guidance from management about their expectations.